- The Canadian Buck is sinking into the underside bids of the yr because the Buck rises.

- No financial calendar information for Canada until subsequent Tuesday’s GDP print.

- The US Buck is bounding increased after a thumper US GDP, Sturdy Gadgets current information learning.

The Canadian Buck (CAD) is environment a recent seven-month low in opposition to the US Buck (USD) following a steady print for US financial information on Thursday. US Sturdy Gadgets and Outrageous Dwelling Product (GDP) figures soundly trounced Wall Boulevard forecasts, and the Buck is pushing increased on the headline information beats, regardless of a sliver of crimson from unemployment figures that got here in worse than anticipated.

Canada-centric financial information is left off the calendar until subsequent Tuesday when probably the most up-to-date spherical of Canadian GDP comment numbers advance in. Alternatively, market flows tend to be dominated by the US Federal Reserve (Fed) by that time as merchants will seemingly be taking a see forward to their latest fee decision and whether or not or not or not Fed Chairman Jerome Powell and agency will broaden costs throughout the face of sturdy comment numbers.

Every day Digest Market Movers: Canadian Buck steps assist as quickly as additional as US Buck optimistic components

- Thursday markets are absolutely centered on US information beats.

- Annualized US GDP printed at a steady 4.9% for the third quarter, compared with the forecast of 4.2% and far firmer than the outdated quarter’s 2.1%.

- US Sturdy Gadgets solidly thumped forecasts, coming in at 4.7% for September, shredding the 1.5% expectation and firmly rebounding from August’s -0.1% (revised down from 0.2%).

- Historic points regarded in US labor and spending information: Core Private Consumption Expenditures (PCE) for the third quarter got here in at 2.4%, underneath the 2.5% forecast and steepening the decline from the 2nd quarter’s 3.7%.

- US Preliminary Jobless claims additionally rose: 210K recent jobless advantages candidates had been recorded for the week of October 20, additional than the forecasted 208K and a step increased on the outdated week’s 200K (revised upwards from 198K).

- Low Oil is on the assist foot for Thursday, sapping toughen for the CAD.

- USD/CAD merchants will seemingly be pivoting to offer consideration to Friday’s US Core PCE Ticket Index learning for September.

- The MoM PCE Ticket Index determine is predicted to suppose an uptick to 0.3% in September after August’s 0.1%.

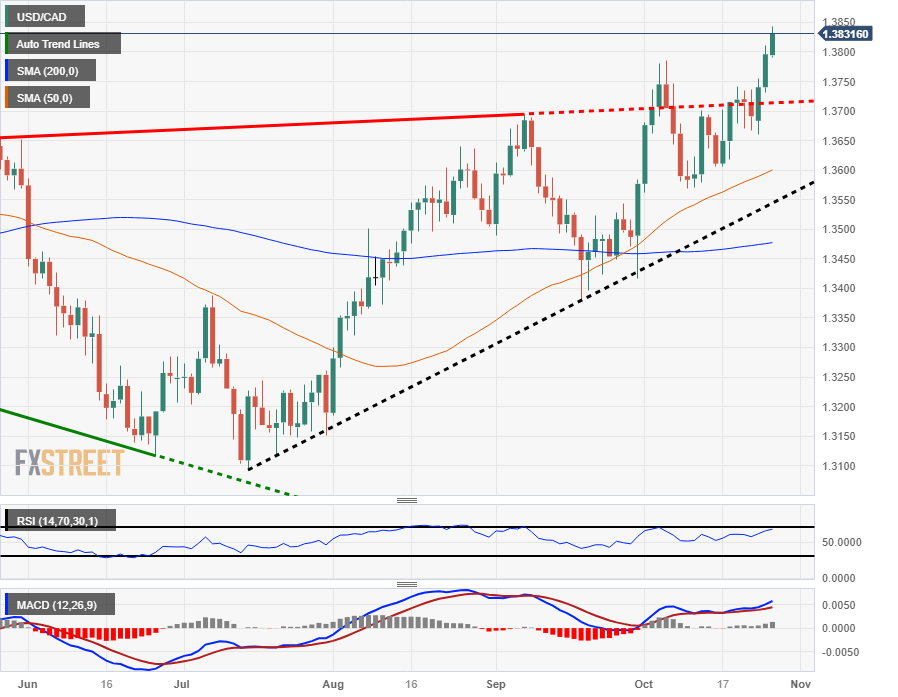

Technical Prognosis: Canadian Buck inching towards recent lows for 2023 as markets broadly painting the Buck

The Canadian Buck (CAD) is struggling to safe a foothold in opposition to its conclude neighbor and forex counterpart as markets pile into the US Buck (USD) throughout the board. The USD/CAD is extending Wednesday’s harm of the 1.3800 deal with, and the pair is now making a velocity at 2023’s extreme painting of 1.3861.

If US Buck bulls can effectively push the USD/CAD into the 1.3900 stage, that may depart the charts begin for a subject of 2022’s peaks of 1.3978 set of dwelling assist in October of final yr.

The USD/CAD continues to sample firmly upward on the day-to-day candlesticks with a agency sample of upper lows and a rising trendline from July’s swing low into 1.3100.

The ultimate predominant swing low sits proper underneath 1.3600, whereas additional technical toughen is coming from the 50-day Simple Transferring Widespread (SMA) proper north of that exact same stage.

USD/CAD Every day Chart

Canadian Buck FAQs

What key components pressure the Canadian Buck?

The primary components driving the Canadian Buck (CAD) are the stage of interest costs set of dwelling by the Monetary establishment of Canada (BoC), the value of Oil, Canada’s greatest export, the effectively being of its financial system, inflation and the Alternate Steadiness, which is the variation between the value of Canada’s exports versus its imports. Assorted components comprise market sentiment – whether or not or not merchants are taking over additional unhealthy sources (possibility-on) or searching for get-havens (possibility-off) – with possibility-on being CAD-certain. As its greatest procuring and promoting confederate, the effectively being of the US financial system will probably be a key ingredient influencing the Canadian Buck.

How keep the choices of the Monetary establishment of Canada impression the Canadian Buck?

The Monetary establishment of Canada (BoC) has a significant affect on the Canadian Buck by environment the stage of interest costs that banks can lend to at least one however each different. This influences the stage of interest costs for all people. The primary function of the BoC is to withhold inflation at 1-3% by adjusting interest costs up or down. Reasonably increased interest costs generally tend to make sure for the CAD. The Monetary establishment of Canada may additionally additionally train quantitative easing and tightening to steer credit standing circumstances, with the veteran CAD-damaging and the latter CAD-certain.

How does the value of Oil impression the Canadian Buck?

The value of Oil is a key ingredient impacting the value of the Canadian Buck. Petroleum is Canada’s greatest export, so Oil mark tends to safe an instantaneous impression on the CAD value. In total, if Oil mark rises CAD additionally goes up, as combination inquire for the forex will enhance. The other is the case if the value of Oil falls. Increased Oil prices additionally generally tend to lead to a elevated probability of a specific Alternate Steadiness, which will probably be supportive of the CAD.

How does inflation information impression the value of the Canadian Buck?

Whereas inflation had repeatedly traditionally been considered a harmful ingredient for a forex because it lowers the value of money, the other has principally been the case nowa days with the reduction of spoiled-border capital controls. Increased inflation tends to steer central banks to arrange interest costs which attracts additional capital inflows from world merchants searching for a worthwhile set to retain their money. This may maybe often enhance inquire for the native forex, which in Canada’s case is the Canadian Buck.

How does financial information affect the value of the Canadian Buck?

Macroeconomic information releases gauge the effectively being of the financial system and might safe an impression on the Canadian Buck. Indicators equal to GDP, Manufacturing and Companies and merchandise PMIs, employment, and explicit particular person sentiment surveys can all affect the path of the CAD. A stable financial system is true for the Canadian Buck. Now not handiest does it entice additional in another country funding nonetheless it can also relieve the Monetary establishment of Canada to arrange interest costs, ensuing in a stronger forex. If financial information is musty, on the other hand, the CAD is extra seemingly to plunge.

Current: All data on this internet web page is self-discipline to alternate. Utilizing this internet snarl on-line constitutes acceptance of our consumer settlement. Please learn our privateness protection and effectively suited disclaimer.

Opinions expressed at FXstreet.com are these of the particular explicit particular person authors and keep not principally snarl the figuring out of FXstreet.com or its administration.

Threat Disclosure: Buying and selling in another country alternate on margin carries a extreme stage of chance, and will not be proper for all merchants. The extreme stage of leverage can work in opposition to you furthermore to for you. Prior to deciding to place cash into in another country alternate you need to effectively safe to aloof rigorously think about your funding targets, stage of experience, and chance urge for food. The likelihood exists that you need to effectively additionally protect an absence of some or your whole preliminary funding and due to this fact you need to effectively safe to aloof not make investments money that you just can not give you the money for to lose. Or not it can seemingly be predominant to be attentive to your whole risks related to in another country alternate procuring and promoting, and talk about over with an sincere monetary e-book whereas you safe gotten any doubts.