[ad_1]

I admit the subject of “finish of 12 months reviews” isn’t all that thrilling, nevertheless it’s very obligatory… in actual fact, if you happen to don’t do that proper it might have some detrimental impacts on your online business.

Irrespective of if you happen to promote on Amazon as a severe revenue stream or as an occasional interest, you’re nonetheless required to report your revenue to the IRS. It’s vital to know that there are a number of reviews you need to you’ll want to ship to your CPA (or whoever is doing all of your taxes).

Earlier than we go any additional I would like you to know that I’m not a tax specialist or providing you with any tax recommendation. I extremely advocate hiring a neighborhood CPA who’s educated of on-line gross sales and all of the tax implications on your state. At this time, I’m solely displaying you find out how to get the reviews that it’s essential to add to all your different 2022 tax paperwork.

For those who’re an InventoryLab person, I’ve superb information for you. The method of getting most of those reviews and numbers is extremely simple. However, if you happen to’re not an InventoryLab person, whereas a few of the reviews in Vendor Central are simple to run, there are different reviews and numbers it’s essential to calculate that might be very time consuming to do.

For those who’ve been maintaining monitor of all of your numbers all year long, this course of will nonetheless be time intensive, however a lot simpler. For those who’re in additional of a “catch-up” mode and making an attempt to get all of your numbers for the 12 months proper now, I extremely advocate this course known as Catch-Up Accounting. You should utilize the coupon code FT20 and save 20% off for a restricted time. It can actually allow you to catch up your numbers to be updated.

Let’s do that!

An important info you’ll must have readily available to offer your CPA are the next:

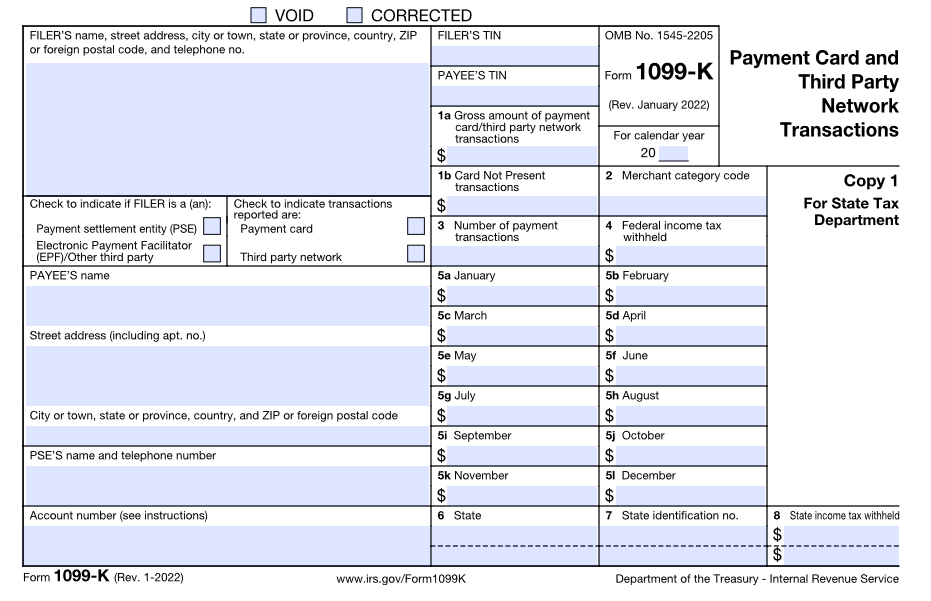

- 1099K from Amazon

- Yr Finish Gross sales Report

- Yr Finish Expense Report

- Yr Finish Value of Items Offered

- Yr Finish Stock Valuation

- Automobile Expense Report

I’ll break down precisely find out how to run the suitable reviews and find out how to entry these numbers within the sections that comply with.

1099K from Amazon

That is a straightforward report to seek out and print out. Your 1099K is the report of your product sales income for the 12 months. You’ll be capable to obtain this report instantly from Amazon if you happen to’ve grossed over $20,000 in unadjusted gross sales and 200 or extra transactions throughout the 12 months OR if you happen to’ve had one transaction in 2022 for over $600 (supply). Amazon will electronic mail you a hyperlink on find out how to entry this type someday in January (often extra towards the top of the month). You will get this report from the Amazon electronic mail they ship you and out of your Amazon Tax Doc Library. The report might be prepared for obtain from Amazon someday after January 1, however earlier than January 31. For those who didn’t qualify for this report, you then’ll want to seek out this info by making a Yr Finish Gross sales Report.

That is a straightforward report to seek out and print out. Your 1099K is the report of your product sales income for the 12 months. You’ll be capable to obtain this report instantly from Amazon if you happen to’ve grossed over $20,000 in unadjusted gross sales and 200 or extra transactions throughout the 12 months OR if you happen to’ve had one transaction in 2022 for over $600 (supply). Amazon will electronic mail you a hyperlink on find out how to entry this type someday in January (often extra towards the top of the month). You will get this report from the Amazon electronic mail they ship you and out of your Amazon Tax Doc Library. The report might be prepared for obtain from Amazon someday after January 1, however earlier than January 31. For those who didn’t qualify for this report, you then’ll want to seek out this info by making a Yr Finish Gross sales Report.

While you take a look at your 1099K from Amazon, you would possibly freak out a bit of as a result of the quantity Amazon provides you would possibly appear like a HUGE quantity. That’s as a result of the 1099K tells you your gross gross sales numbers with out factoring in issues like Amazon charges, returns, and different bills. The product sales quantity is vital to know, nevertheless it’s not the quantity you’ll wish to report as an correct reflection of your precise income. That’s why we’re working these different reviews as effectively.

For those who didn’t qualify to get a 1099K from Amazon (grossed below $20,000 in unadjusted gross sales and below 200 or extra transactions), that doesn’t imply you’re exempt from reporting your revenue. It simply means you’ll have to make use of the Yr Finish Gross sales Report (see under) in an effort to get the information it’s essential to correctly report your revenue.

Yr Finish Gross sales Report

This report provides you a number of details about your Amazon gross sales numbers together with your FBA gross sales, non-FBA gross sales, complete Amazon bills, and complete refunds for the 12 months.

For those who didn’t meet the $20,000 gross sales and 200 transactions qualification to get a 1099K, you continue to must report your numbers to the IRS. You are able to do that by working some vendor reviews in Vendor Central. Right here’s how:

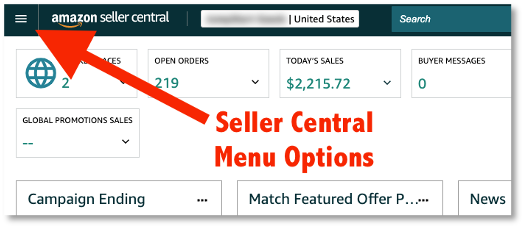

Log in to Vendor Central, click on the three line icon within the high left nook of the display screen, hover over the REPORTS header, and click on on the PAYMENTS possibility.

Log in to Vendor Central, click on the three line icon within the high left nook of the display screen, hover over the REPORTS header, and click on on the PAYMENTS possibility.- Click on on the DATE RANGE REPORTS tab.

- Click on the GENERATE REPORT button.

- Choose the SUMMARY possibility.

- Select the account sort you wish to embrace.

- Choose the CUSTOM date vary possibility and enter from 01/01 of the 12 months to 12/31 of the identical 12 months.

- Click on GENERATE.

For those who do the above steps earlier than December 31, then Amazon will schedule this report back to be run very first thing January 1. Simply keep in mind to come back again to this report web page to obtain this report. It will likely be there ready so that you can obtain.

For those who run this report after January 1, then Amazon will simply want just a few moments to create this report. You may refresh the hyperlink on the report after a couple of minutes, and you need to be capable to obtain it at that second.

This Yr Finish Gross sales Report PDF gives you a one-page abstract of your revenue (Amazon gross sales), bills (Amazon charges), refunds, gross sales tax, and financial institution transfers. This can be a PDF that your CPA will wish to have in an effort to finest do your taxes.

However, after all, you have got had a number of different bills (stock, containers, workplace provides, sourcing apps, program subscriptions, and so forth.) apart from Amazon charges, proper? So how can we get these bills? A technique is to create a Yr Finish Expense Report.

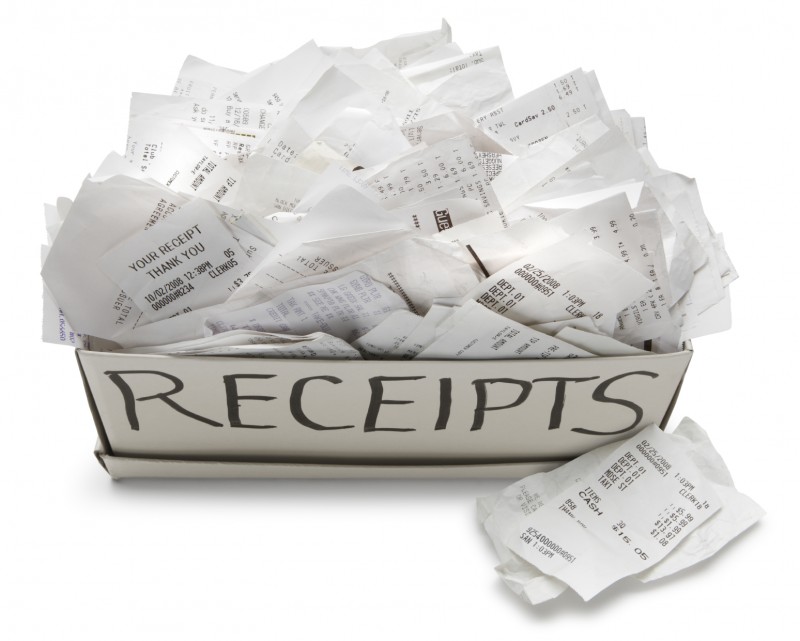

Yr Finish Expense Report

Hopefully you’ve been maintaining monitor of all of your bills for the 12 months (in addition to all the receipts, proper?). There are lots of other ways individuals monitor their bills. Some individuals use a spreadsheet, some use software program options like InventoryLab, and a few even give their CPA or bookkeeper entry to their enterprise checking account to trace their bills.

Hopefully you’ve been maintaining monitor of all of your bills for the 12 months (in addition to all the receipts, proper?). There are lots of other ways individuals monitor their bills. Some individuals use a spreadsheet, some use software program options like InventoryLab, and a few even give their CPA or bookkeeper entry to their enterprise checking account to trace their bills.

For those who use a spreadsheet, take a while to double test that every one your numbers are recorded appropriately. Most individuals have these sort of bills: stock, workplace provides, transport provides, bodily instruments, pc packages, enterprise associated subscriptions, coaching supplies (like this course), contract labor, and the rest legitimately linked with a enterprise goal.

For those who use InventoryLab and have tracked all your bills there all year long, then you may simply run a Yr Finish Expense Report. Right here’s how:

- Log in to InventoryLab, hover over the ACCOUNTING tab and click on the OTHER EXPENSES report.

- Then click on on the ADVANCED SEARCH button.

- Search the EXPENSE DATE from 01/01 to 012/31 of the 12 months you’re eager to run the report for and click on SEARCH.

On the backside of the display screen, you’ll see your complete bills for the time interval you entered. You should utilize this quantity to offer to your CPA. You can too click on on the EXPORT button and have a spreadsheet model of the complete report.

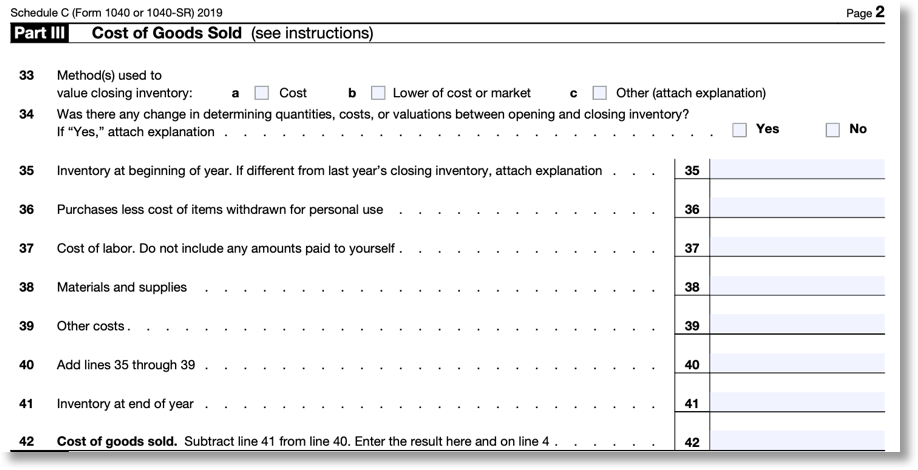

Yr Finish Value of Items Offered

That is the quantity that totals up the price of all of the objects you bought for the 12 months. The best strategy to get this quantity is to run a fast report inside InventoryLab. The report solely takes a second to run and is tremendous simple.

In case you are an InventoryLab person, right here’s find out how to get your year-end value of products bought:

- Log in to InventoryLab, hover over REPORTS, and click on on PROFIT & LOSS.

- Click on on the YEARLY report and select the calendar 12 months you wish to run.

- Click on the VIEW button.

- Click on EXPORT so that you’ll have a digital copy of this report.

On the report, you may see the road merchandise of Value of Items Offered. Have a look at the yearly complete and you’ve got your Value of Items Offered quantity for the 12 months (supplied you entered in your value of products when itemizing your stock into InventoryLab).

However, if you happen to’re not an InventoryLab person, this course of is considerably tougher to calculate, however not unattainable. You should utilize an IRS kind 1040 – Schedule C that will help you determine your year-end Value of Items Offered. Beneath is an instance from 2020 on find out how to calculate this quantity:

As all the time, do your due diligence to be sure to’re utilizing the proper 12 months’s paperwork when calculating this quantity. Most significantly, speak this over with a neighborhood CPA to be sure to’re doing this appropriately.

Stock Valuation Report

The Stock Valuation Report will inform you the present worth of your stock that you just at present have in inventory at Amazon achievement facilities (for FBA sellers). Simply know that this report must be run after January 1 of the brand new 12 months. For those who run it earlier than, it is not going to work appropriately.

For those who’re utilizing InventoryLab, this report is tremendous simple to run. Right here’s how:

- Log in to InventoryLab, hover over REPORTS, and click on on INVENTORY VALUATION.

- Enter the date 12/31 of the 12 months you wish to run this report for and click on VIEW.

- To get a digital copy, click on on the EXPORT button.

Not an InventoryLab person? To calculate your finish of 12 months Stock Valuation you’ll first must run a Month-to-month Stock Historical past report in Vendor Central proper after the brand new 12 months. For those who do the above steps earlier than December 31, then the report is not going to work appropriately. This gives you a listing of stock objects in inventory on the finish of December (i.e. the top of the 12 months) that you should use to calculate the worth of your year-end stock:

Log in to Vendor Central, click on the three line icon within the high left nook of the display screen, hover over the REPORTS header, and click on on the FULFILLMENT possibility.

Log in to Vendor Central, click on the three line icon within the high left nook of the display screen, hover over the REPORTS header, and click on on the FULFILLMENT possibility.- Within the INVENTORY part on the left, click on SHOW MORE.

- Click on MONTHLY INVENTORY HISTORY within the INVENTORY part.

- Click on on the DOWNLOAD tab.

- Within the EVENT MONTH dropdown, choose EXACT MONTHS.

- Select From: (12) DECEMBER 2022 to: (12) DECEMBER 2022.

- Click on the REQUEST .CSV DOWNLOAD button.

Once more, if you happen to do the above steps earlier than December 31, then the report is not going to work appropriately.

While you run this report after January 1, then Amazon often will simply want just a few moments to create this report. You may refresh the hyperlink on the report after a couple of minutes, after which you need to be capable to obtain it at that second. For those who ever get a message that claims “No Knowledge Out there,” then don’t fear. Amazon could also be busy and want just a few days to create this report. Come again later and see if the report has been accomplished.

Now that you’ve got the file, you may open it up in a spreadsheet doc. The vital data you’re in search of is within the “Finish Amount” column. The numbers you see would be the in-stock amount at Amazon as of 12/31/22. Inside the spreadsheet program, you may type the “Finish Amount” column from greater numbers to smaller numbers, after which simply delete any line that has a amount variety of zero. Now you have got a spreadsheet displaying you the in-stock inventory ranges for the top of the 12 months.

Now that you’ve got the file, you may open it up in a spreadsheet doc. The vital data you’re in search of is within the “Finish Amount” column. The numbers you see would be the in-stock amount at Amazon as of 12/31/22. Inside the spreadsheet program, you may type the “Finish Amount” column from greater numbers to smaller numbers, after which simply delete any line that has a amount variety of zero. Now you have got a spreadsheet displaying you the in-stock inventory ranges for the top of the 12 months.

Right here is the laborious and tedious a part of this course of. Now you’ll must go line by line and determine the purchase value of every of these things you have got in inventory. You most likely might want to reference your receipts to get the proper purchase prices for these things. This takes a ton of time (relying on the scale of your stock) however is critical to report your numbers appropriately. As soon as you’re completed, you’ll have your FBA stock valuation.

After all, that’s simply your year-end FBA stock. Different stock that you just’ll want so as to add to this valuation consists of any objects you’re Service provider Fulfilling, stock you’ve ordered that has not been delivered to your property/prep heart but, stock that’s on its strategy to Amazon however not checked in, and any stock you have got sitting round your home/workplace that has not been despatched to Amazon but as of midnight of January 1.

Automobile Expense Report

Your entire business-related miles are tax deductible. These drives might embrace storage saling, thrifting, retail arbitrage, journeys to the shop to purchase business-related provides, journeys to drop off shipments at UPS, and every other business-related driving. All of those miles are tax deductible.

Your entire business-related miles are tax deductible. These drives might embrace storage saling, thrifting, retail arbitrage, journeys to the shop to purchase business-related provides, journeys to drop off shipments at UPS, and every other business-related driving. All of those miles are tax deductible.

Whether or not you retain monitor of your miles in a pocket book, in a spreadsheet, or by utilizing the MileIQ app (your miles tracked robotically – extremely advocate), you’ll want to get your mileage for the 12 months to your CPA to allow them to deduct these miles out of your taxes. For those who’re not a MileIQ person, right here is our assessment of MileIQ.

![]()

Ultimately, you’ll have all the numbers and reviews it’s essential to give to your CPA:

- 1099K from Amazon

- Yr Finish Gross sales Report

- Yr Finish Expense Report

- Yr Finish Value of Items Offered

- Yr Finish Stock Valuation

- Automobile Expense Report

Get all of those reviews to your CPA ASAP. Tax day doe 2023 is April 18, however that day will come in a short time if you happen to don’t collect up all these numbers and reviews quickly.

You actually don’t wish to be late on getting the tax course of began. Once more, if you happen to don’t have a CPA, I extremely advocate getting one as quickly as doable. It may appear pricey, however you wish to be certain your numbers are proper, and also you desire a skilled to do the work that will eat up manner an excessive amount of of your time if you happen to did it your self.

Once more, I like to recommend utilizing InventoryLab to maintain monitor of all your online business bills like value of products, mileage, provides, and so forth. For those who don’t have all your bills’ knowledge saved in a single place, I extremely advocate utilizing InventoryLab – particularly at the beginning of a brand new 12 months so you may have all your monetary knowledge in a single place from the beginning of the 12 months. Get a free month of InventoryLab by clicking right here.

Once more, I like to recommend utilizing InventoryLab to maintain monitor of all your online business bills like value of products, mileage, provides, and so forth. For those who don’t have all your bills’ knowledge saved in a single place, I extremely advocate utilizing InventoryLab – particularly at the beginning of a brand new 12 months so you may have all your monetary knowledge in a single place from the beginning of the 12 months. Get a free month of InventoryLab by clicking right here.

In case you are an InventoryLab person, then here’s a video on find out how to use InventoryLab to be sure to’re prepared for year-end tax reviews and what it’s essential to do earlier than and after December thirty first.

For those who don’t use InventoryLab, or if every part I mentioned above appears complicated and also you’d quite have a set of movies strolling you thru find out how to deal with your 12 months finish taxes, otherwise you’re realizing that you just’ll be doing a number of “catch up” accounting for the 2022 tax 12 months, then I extremely advocate the video course Catch Up Accounting. You may even use the limited-time coupon code FT20 and save 20% off the course.

For those who don’t use InventoryLab, or if every part I mentioned above appears complicated and also you’d quite have a set of movies strolling you thru find out how to deal with your 12 months finish taxes, otherwise you’re realizing that you just’ll be doing a number of “catch up” accounting for the 2022 tax 12 months, then I extremely advocate the video course Catch Up Accounting. You may even use the limited-time coupon code FT20 and save 20% off the course.

I simply completed watching all of the movies within the Catch Up Accounting course (not lengthy in any respect) and it’s tremendous useful for these of you who’re behind in determining find out how to make sense of all of your Amazon numbers relating to tax functions.

*Publish up to date for 2022

![]()

Make this new 12 months your Finest Amazon Gross sales Yr Ever!

Make this new 12 months your Finest Amazon Gross sales Yr Ever!

Think about understanding precisely what to anticipate in your Amazon FBA enterprise each month of the 12 months.

Think about what it might really feel like understanding you weren’t lacking out on any of the alternatives that may come your manner within the new 12 months.

Think about working in your Amazon enterprise understanding precisely what your priorities are, what it’s essential to keep away from, and what it’s essential to accomplish throughout every month to make progress towards making the brand new 12 months your finest gross sales 12 months ever.

Discover out extra about The Reseller’s Information to a Yr in FBA: A Month by Month Information to a Worthwhile Amazon Enterprise at present. The package deal features a 275+ web page e-book, interactive coaching webinars all year long, 12+ hours of video coaching, and 4 particular bonuses.

![]()

For those who favored this put up and located it useful, scroll again as much as the highest and subscribe to the weblog. I’ll replace you about as soon as every week with useful recommendations on how one can make a full-time revenue with FBA.

Okay, the 12 months is nearly over. What different issues are you doing over the last week of the 12 months in an effort to put together for subsequent 12 months? I’d love to listen to what you’re as much as this week!

[ad_2]

Log in to Vendor Central, click on the three line icon within the high left nook of the display screen, hover over the REPORTS header, and click on on the PAYMENTS possibility.

Log in to Vendor Central, click on the three line icon within the high left nook of the display screen, hover over the REPORTS header, and click on on the PAYMENTS possibility.