[ad_1]

Based in 2014, Blossom Finance was first meant for Muslim entrepreneurs in the USA. The microfinancing platform connects buyers with small companies utilizing mudarabah, a shariah-compliant profit-sharing settlement. However founder Matthew Joseph Martin quickly realized that the startup, backed by buyers like Increase VC and Tim Draper, was serving a comparatively area of interest market within the States. So he began researching markets with massive populations of Muslim folks. Indonesia emerged as your best option.

Southeast Asia is already house to a thriving fintech scene, the place Seize, GoTo and Sea have constructed tremendous apps that embody monetary providers, and startups like Xendit, Akulaku and Dana (to call just a few) have raised tons of of thousands and thousands of {dollars} for funds, banking providers and different monetary instruments. Indonesia and Malaysia, within the coronary heart of Southeast Asia, are among the many nations with the biggest Muslim populations on this planet.

These elements are proving fertile floor for establishing and rising fintechs that focus solely on Islamic finance, providing services and products that comply with shariah legislation. Amongst different issues, this forbids accruing curiosity, hypothesis and financing non-halal merchandise like pork, tobacco and alcohol.

In line with the World Financial institution, Indonesia has probably the most Islamic fintech corporations on this planet – maybe becoming, because it’s additionally probably the most populous Muslim-majority nation on this planet with about 231 million Muslims.

Some notable Islamic fintech corporations embrace peer-to-peer lending platform and digital financial institution Hijra (previously generally known as Alami), on-line financial institution Financial institution Aladin, LinkAja, which is backed by Telkomsel and Financial institution Mandri, the biggest financial institution in Indonesia by way of asset loans and deposits.

Gojek’s GoPay can also be partnered with the Indonesia mosque council to permit customers to make zakat, or compulsory alms giving, on-line.

In the meantime in Malaysia, the place 61.3% out of its 33.6 million inhabitants apply Islam, fintech corporations that target Islamic finance embrace crowdfunding platform Ethis Ventures and funding platform Wahed, which is the one shariah-compliant robo-advisory platform within the nation. Funding Societies, the SoftBank Imaginative and prescient Fund II-backed SME digital lending platform, just lately launched a shariah-compliant financing product there, and now gives it because the default product to all its Malaysian clients.

Shariah legislation requires a distinct strategy to monetary providers, and traditional banks are additionally launching merchandise for Muslim clients. Together with the rising variety of Islamic fintech startups digitizing the method, Islamic-compliant providers have gotten accessible to extra folks.

Revenue sharing as a substitute of debt

The seed of Blossom Finance was planted when Martin was working a undertaking within the U.S. enabling folks to purchase Bitcoin. He ran right into a receivables drawback, and the standard approach to finance money receivables is to get line of credit score or receivables financing from a financial institution. As a working towards Muslim, nonetheless, Martin couldn’t use typical loans. However he additionally couldn’t discover another choices within the U.S.

“Fairly naively, I assumed there are many Muslims who personal companies, absolutely they face the identical drawback,” he stated. “They will need to have an answer. So what’s the answer?”

After studying extra concerning the ideas of Islamic finance, Martin launched Blossom Finance, a platform that connects buyers with microbanks, which in flip disburse shariah-compliant financing to microbusinesses. Headquartered in Delaware, Blossom Finance hosts buyers from primarily the USA and Europe, however the entire microbusinesses it serves are in Indonesia.

After initially soft-launching within the U.S., the Blossom Finance crew realized that the market there for Islamic finance was very small, stated Martin. They began searching for an even bigger market, and landed on Indonesia due to the monetary inclusion challenges going through micro and small companies.

Different causes Blossom Finance selected Indonesia over different nations with massive Muslim populations included its relative political stability, Martin stated. It additionally has a robust baseline infrastructure for working companies with primarily international capital.

“There’s already been over the previous twenty years previous to us arriving tons of wonderful work,” Martin stated. “Loads of the groundwork was already there and we had been in a position to are available in and function as a connector the place there are inefficiencies, and a scarcity of capital. We had been in a position to bridge that lack of capital utilizing a know-how answer. All that underlying infrastructure for the final mile of serving the microbusinesses was already there and we had been in a position to faucet into it.”

Buyers on Blossom Finance’s platform pool their cash into funds, or cooperatives, that are then managed by microbanks. The microbanks disburse the financing to microbusinesses to buy stock and different issues they want. All losses and income are shared professional rata, Martin defined. If an investor’s capital is 1% of a fund, they will count on to obtain 1% of its income, or take in losses on the similar charge.

What makes Blossom Finance’s microfinance platform shariah-compliant is its use of murabaha contracts as a substitute of conventional interest-charging loans. For instance, when a microbusiness, like a nook retailer, wants to purchase stock like drinks or snacks, they go to one of many cooperatives for financing. Martin explains that the idea of the financing is just not the capital, however the commodity that must be bought. The cooperative purchases it at wholesale costs and supplies it to the enterprise at a markup as a substitute of charging curiosity. They then share the revenue with buyers. Martin stated cooperatives can usually join microbusinesses with wholesalers that they didn’t beforehand know, and likewise profit from economies of scale, which additionally helps microbusinesses.

An Indonesian warung, or small retailer promoting snacks, drinks and day by day use gadgets (Gratsias Adhi Hermawan/Getty)

Cooperatives don’t set costs, and as a substitute mudarabah agreements are based mostly on present market costs, which microbusinesses comply with. To verify microbusinesses get truthful agreements from microbanks, value of funding for microbusinesses is likely one of the issues Blossom Finance takes into consideration when deciding whether or not to work with a cooperative/microbank.

“Let’s say you’re the financial institution and I need to purchase chickens. You agree to purchase me 100 chickens. Let’s say it prices $1,000. We are going to agree that your revenue will probably be 20%, so I’ve to pay you $1,200 over the course of, say, 12 months. So that you because the financier have that 20% revenue,” Martin stated.

The benefit of working with cooperatives as a substitute of business banks is that they supply extra versatile fee phrases and financing tenure, which is useful if a enterprise runs into monetary problem, Martin added.

Martin stated there may be dialogue amongst Islamic students about whether or not or not profit-sharing is inherently higher than debt. However, he asks, “if fairness and debt are equal, why is it that the Prophet Muhammed prayed for cover from debt? I believe all of us inherently know the reply to that query, as a result of debt can lure the poor in a cycle of poverty that they can’t escape. Fairness, then again, includes the idea of danger participation. Buyers hopefully have a greater upside, and the rationale they get that higher upside is as a result of they’re collaborating equally with the entrepreneur by way of danger.”

Fostering monetary inclusion

A 2022 report by analysis agency DinarStandard and fintech Ellipses estimates that the market dimension of Islamic fintech within the Organisation of Islamic Coorporation (OIC) nations was $79 billion in 2021, making up 0.83% of world fintech transaction quantity. Whereas Islamic fintech’s market dimension continues to be small, it’s anticipated to achieve $179 billion at a 17.9% CAGR by 2026, outpacing conventional fintech’s 13.5% CAGR progress over the identical interval.

DinarStandard and Ellipses additionally discovered that there are 375 Islamic fintech corporations around the globe. Most are within the P2P financing area, and Indonesia is likely one of the high markets in transaction quantity.

Islamic fintech startups in Malaysia and Indonesia have the help of presidency insurance policies. For instance, Indonesia’s Nationwide Islamic Finance Committee is targeted on growing Islamic finance and the nation’s Islamic financial system.

And in Malaysia, Financial institution Negara’s Investments Accounts Platform is the primary Islamic P2P initiative established by a central financial institution, whereas the government-owned Malaysia Digital Financial system Company connects buyers with halal enterprise house owners. In 2019, the Malaysian authorities additionally issued its Shared Prosperity Imaginative and prescient 2030, a 10-year framework for restructuring its financial system that features constructing an Islamic fintech hub as a key a part of its technique.

The World Financial institution has stated that the expansion of Islamic fintech can foster monetary inclusion by giving unbanked folks entry to monetary providers.

For instance, one group of individuals it could attain are those that keep away from financial institution accounts as a result of their phrases aren’t shariah-compliant, and wish usury-free monetary transactions based mostly on risk-sharing. Islamic fintech also can assist resolve points that unbanked folks face, like lack of cash, lack of correct documentation and being situated distant from typical Islamic banks.

Golden Gate Ventures companion Justin Corridor, an investor in Hijra and Funding Societies, believes that Islamic fintech makes Islamic monetary providers accessible to extra folks.

“Islamic banks are terribly conservative, not solely with how they function, however the price of financing, who they will lend to, and so forth.,” he stated. “Having corporations that differentiate from that and supply a pleasant client expertise on the digital banking facet, however throughout the framework of an Islamic financial institution, there’s a possibility there.”

The World Financial institution additionally says the Islamic microfinancing, or short-term financing with phrases of lower than 12 months, can play an necessary function in assuaging poverty in OIC nations since they work with clients who are sometimes underserved by conventional banks.

One instance of a fintech firm creating shariah-compliant merchandise for underserved clients is Funding Societies, which is headquartered in Singapore with operations in Indonesia, Malaysia and Thailand.

Kien Poon Chai, the nation supervisor of Funding Societies Malaysia, stated its shariah-compliant financing product was launched in 2022 to serve comparatively new micro- and small companies, that are often neglected by banks when searching for working capital.

Chai stated the impetus for launching shariah-compliant financing merchandise was as a result of Malaysia has a big Muslim inhabitants and the corporate was seeing demand from lenders and SMEs searching for financing merchandise according to their religion.

Funding Societies underwrites its shariah-compliant financing product in the identical method as its typical financing counterparts, however there are a number of nuances it has to pay shut consideration to. For instance, financing can’t be used for non-halal companies, together with ones that promote alcohol, pork, tobacco or therapeutic massage homes.

Monetary gives additionally need to be backed by underlying belongings, so for each disbursement Funding Societies makes by means of its shariah-compliant product, it has to buy underlying commodities by means of exchanges.

Charge disclosures and fees additionally need to be shariah-compliant. There can’t be uncertainty in financing merchandise, so all charges and fees should be clearly outlined and outlined. For instance, penalizing folks for early reimbursement with prepayment charges is forbidden.

Peer-to-peer lending with out curiosity

One other Islamic startup targeted on monetary inclusion is P2P lending platform and neobank Hijra. Based in 2018, Hijra has raised $30 million in fairness from buyers like Quona Capital, Golden Gate Ventures and EV Development. It first began as an aggregator of conventional Islamic banks serving SMEs, however co-founder and CEO Dima Djani advised TechCrunch that after about 9 months, the crew realized that the Islamic banking trade in Indonesia couldn’t sustain with the expansion of fintech.

In consequence, Hijra obtained licensed by Indonesia’s Monetary Providers Authority (OJK) in 2019 to function as a digital lending platform. Then retail lenders started asking for extra complete monetary providers, so Hijra, then generally known as Alami (which continues to be the title of its P2P lending platform) acquired a small Islamic financial institution final 12 months and launched a brand new digital financial institution with financial savings accounts and cash transfers.

The primary purpose Djani needed to launch an Islamic finance platform is as a result of Indonesia has one of many largest Muslim populations on this planet, however the penetration of Islamic finance was nonetheless very low, at about 6% to 7% of whole banking belongings, in comparison with about 30% penetration in Malaysia. Djani attributes this to low client consciousness of Islamic finance, however says a brand new wave of spiritual lecturers, who acquire followers on social media, has given rise to a robust halal financial system over the past 10 years and likewise spurred curiosity amongst millennial and Gen Z Muslims in adopting providers which are tailor-made to their religion.

In Indonesia, the rules for Islamic finance are decided by three authorities, stated researcher Fahmi Ali Hadaefi. These are the Monetary Providers Authority (OJK), which regulates and supervises the monetary providers sector, Financial institution Indonesia, which oversees banks, and the Majelis Ulama Indonesia (Nationwide Sharia Board-MUI), or the nation’s main Islamic students physique.

The MUI has revealed no less than two fatwas on fintech. The primary, issued in 2017, is about Islamic views on practices associated to e-money. The second, issued a 12 months later with the Monetary Providers Authority, covers Islamic fundamentals for P2P lending.

Since Muslims are prohibited from interest-bearing transactions, Hijra’s crew needed to supply an alternate for customers in want of working capital financing. Like Blossom Finance, it makes use of a profit-sharing mannequin to keep away from curiosity.

The best way it handles P2P loans between lenders and farmers is one instance. When a fish farmer wants to purchase feed, they don’t take out a mortgage with curiosity from a lender. As an alternative, their lender buys fish feed and sells it at a revenue to the farmer, with markups based mostly on present market charges. As an alternative of paying for the feed instantly, farmers pay it off after harvesting fish in about three to 4 months.

Islamic finance is supposed to create a clear and truthful monetary service for everybody,” stated Djani. “For instance, we view curiosity or usury as an unfair instrument on its mechanics. As well as, we additionally view that hypothesis and playing as unfair, as they don’t commensurate the hassle and return evenly.”

Harvesting fish on Ganga Island, North Sulawesi, Indonesia (Giordano Cipriani/Getty)

Hijra’s digital banking app, which it was in a position to launch after buying the small Islamic financial institution in Jakarta, doesn’t give any yield to depositors in the meanwhile, however it additionally doesn’t cost them any charges. Sooner or later, Hijra is planning to launch extra sharia-compliant monetary options, like rent-to-own, funds and community-driven financial savings for teams of people that have a standard objective, like saving cash for a visit to Mecca.

Constructing a halal fee gateway

One other instance of an organization based to get extra Muslims collaborating in digital monetary providers is PayHalal, which was created to supply a shariah-compliant on-line fee gateway.

Co-founder Pat Salam Thevarajah advised TechCrunch that he and fellow PayHalal co-founders realized in 2016 that in the event that they needed to get extra folks within the Muslim group to undertake on-line funds, they must construct their complete tech stack from the bottom up, as a substitute of going to a white-label supplier like Ayden. Thevarajah stated that 55% of the Malaysian inhabitants is unbanked primarily as a result of they worry riba, or curiosity.

“We constructed it due to the pure necessity to create end-to-end compliance into the transaction. That’s how PayHalal took place. The first goal is to maintain fee free from riba and gharar, or hypothesis, in order that Muslims are in a position to carry out digital funds in individual or e-commerce with none type of non-compliance.”

Certainly one of PayHalal’s targets is to create a community like Visa or Mastercard that stays true to Islamic finance ideas. One key distinction is the shortage of curiosity.

Standard fee gateways deal with cash as a commodity, which implies it may be bought at a worth increased than face worth or lent out with curiosity. PayHalal doesn’t deal with cash as a commodity, as a substitute solely utilizing it to buy items and providers, and makes revenue on the buying and selling of products or providers. PayHalal makes positive its providers are shariah-compliant with the assistance of two crew members, scholar Dr. Daud Bakar and co-founder Indrawathi Selvarajah, who was a company lawyer earlier than she grew to become a shariah fintech specialist.

Proper now, when an instrument comes from a traditional monetary establishment, PayHalal feeds it into its AI-based non-shariah compliance screening software. The software then suggests remedy based mostly on the quantity of non-compliance issue, and PayHalal says that it takes the price it earns on the transaction, writes it off and contributes it to social work, like feeding poor folks or constructing mosques, as a part of a course of known as purification.

Thevarajah stated the method is auditable as a result of Islamic monetary establishments have inner shariah compliance departments, which in flip bear common audits by exterior shariah supervisory boards. The method of figuring out non-compliant transactions, writing off income and donating charges is documented and reviewed by inner and exterior auditors for accuracy.

Some examples of shariah non-compliant transactions embrace ones that contain the sale of forbidden gadgets like alcohol, tobacco and pork. Transactions that contain riba or gharar are additionally thought of non-compliant, and these can embrace curiosity charged on late funds or unsure phrases utilized in gross sales contracts.

“There is no such thing as a assure that we will preserve riba away, except it’s a closed-loop Islamic transaction,” stated Thevarajah. “If it turns into an open-loop transaction, we’re then required to do purification.”

Instances of non-compliant transactions it tries to keep away from embrace the alternate of products for consumption that aren’t made with halal elements. One other is in instances of salaam contracts, the place a purchaser pays instantly for one thing that will probably be delivered at a later date. When that type of transaction is dealt with by PayHalal, it mitigates chargebacks by ensuring clients get their items on the agreed upon time.

“Transparency is prime with Islamic transactions,” Thevarajah stated.

Certainly one of PayHalal’s targets is to construct a brilliant app with completely different shariah-compliant monetary providers, like insurance coverage merchandise and saving accounts for pilgrimages to Mecca. It just lately took a step towards increasing its product portfolio by launching a shariah-compliant purchase now, pay later service with Atome. The BNPL program is interest-free and has no annual and servicing charges. It’s at the moment onboarding retailers who supply halal and shariah-compliant providers and merchandise.

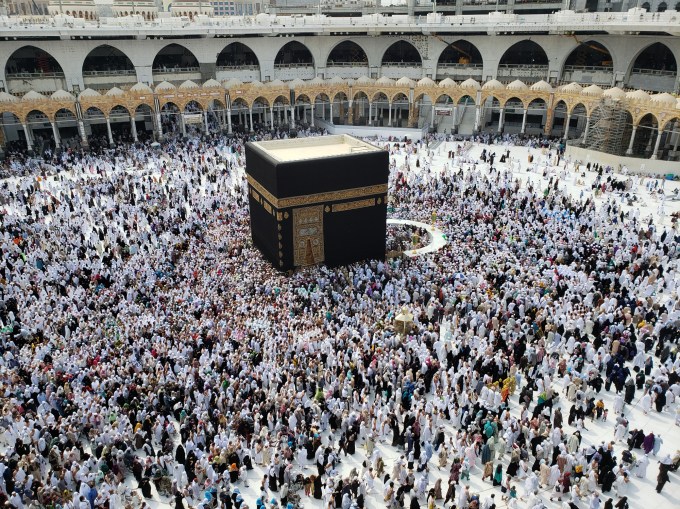

Mecca throughout the Hajj pilgrimage (Reptile8488/Getty)

Thevarajah explains that if a buyer defaults past the three-month time period of the mortgage, PayHalal can’t cost curiosity. As an alternative, it has to underwrite the whole transaction. “Our contract with the service provider could be lively participation the place we purchase the product and we resell it to the buyer for the consideration of a price,” he stated, including “The contract adjustments the whole construction of how an Islamic purchase now, pay later operates.”

Thevarajah added that transactions are structured as deferred fee gross sales, which implies PayHalal, performing as the vendor, buys the product for a provider after which sells it to a buyer at a revenue margin. The client than pays off the whole worth of the product in installments over a predetermined time frame. The transaction is asset-based, which signifies that it’s secured in opposition to the product being bought, not the client’s creditworthiness.

Nonetheless early days

The rise of Islamic fintech in markets like Indonesia and Malaysia is tied to the expansion of Islamic finance in Southeast Asia. In line with a S&P report revealed final 12 months, Southeast Asia’s $290 billion Islamic banking market is anticipated to proceed rising at a CAGR of about 8%. In Malaysia, Islamic banks will make up 45% of the general business banking mortgage e book by the top of 2025, and in Indonesia, Islamic finance’s market share is anticipated to develop to 10% by the top of 2026, at a quicker charge than typical banks.

However Islamic fintech nonetheless makes up a really small share of the whole market. As acknowledged earlier, DinarStandard and Ellipses estimate that the market dimension of Islamic fintech in was OIC nations was $79 billion in 2021, or simply 0.83% of world fintech transaction quantity. However that’s not stopping Hijra from making worldwide growth plans—the crew already has an eye fixed on Malaysia, Turkey and Saudi Arabia.

Golden Gate’s Justin Corridor, additionally an investor in Hijra and Funding Societies, believes Indonesia is uniquely positioned to be a beginning floor for Islamic banks to develop to different markets around the globe.

“Indonesia is the one nation at present that has a confluence of operators that perceive Islamic banking, in addition to serial entrepreneurs, institutional LPs which are keen to capitalize corporations which are doing that, and a really, very massive home market. It’s very uncommon to discover a mannequin distinctive to Southeast Asia that may go world and I truly don’t know of any however Islamic fintech.”

As Muslim fintechs create a extra inclusive market panorama for Muslim customers, they’re additionally engaged on their very own inclusivity points, reminiscent of getting extra girls into the sector of monetary know-how companies.

Djani stated the speed of girls working in Muslim fintech continues to be comparatively low, although some have promoted girls to management roles, together with Hijra’s chief monetary officer Febriny Rimenta.

One of many co-founders of PayHalal, Selvarajah, is a lady and Thevarajah stated Muslim fintech startups can take a number of steps to get extra girls into the area, together with constructing a gender-inclusive office based mostly on Islamic values, offering versatile working preparations, mentorship and selling transparency to construct belief with girls staff.

He added that Muslim fintech startups can design merchandise, together with financial savings and funding platforms, to extend girls’s monetary empowerment.

Martin stated the cooperatives Blossom Finance works with usually have a excessive illustration of girls, with one that’s staffed utterly by girls.

Obstacles exist in different elements of the area, too. On the fundraising entrance, Martin stated one of many foremost obstacles he confronted within the U.S. was educating buyers.

“First you need to clarify what does Islam say and why is that this even an issue, and then you definitely clarify your scenario. In order that was a problem. Nonetheless, I might say for VCs who had been in a position to join the dots and perceive it was a real drawback—there have been some that did say, okay, perhaps that is too area of interest and so they handed—however for individuals who had been in a position to take the time to know the issue, we didn’t face any limitations.

Maybe surprisingly, probably the most pushback he obtained was from different Muslims.

“The place we did face limitations was inside Muslims dwelling as a minority in America. They pushed again in opposition to: ‘why are you calling this Muslim? Why are you targeted on Islam?’” he stated. “Very curiously, the enterprise capital buyers [who did back us] had been like, this is smart. This is a vital area of interest. I believe that goes again to being a minority and post-9/11, and being defensive. There’s that resistance versus going to a Muslim-majority [market], the place it’s like “properly after all you’re doing Muslim finance, why wouldn’t you?”

For Islamic fintechs, discovering buyers also can imply doing their very own due diligence.

PayHalal, which has obtained $4.5 million in seed funding from Asad Capital, Q Cap, Efficient Shields and Crescent Capital, is now within the technique of elevating a $5 million Sequence A spherical at a valuation of $33.5 million. Thevarajah stated a part of fundraising means assessing potential buyers to make sure each they and their fund administration is finished in alignment with shariah ideas.

“Investor curiosity within the Islamic fintech sector for PayHalal was very excessive because of its potential in a fast-growing Muslim inhabitants worldwide,” Thevarajah stated. “Whereas some buyers considered it as a captive market as a result of non secular beliefs of the Muslim group concerning halal meals and transactions, we nonetheless had to make sure that potential buyers fell throughout the match and correct class for Islamic monetary providers.”

Founders in nations with massive Muslim populations say additionally they needed to educate buyers, however that’s altering. The $30 million Hijra has raised in fairness to this point is nearly all from non-Muslim nations. Djani stated a number of of its buyers already had a robust curiosity in Islamic monetary providers as a result of it’s a rising area of interest that is ready to present differentiation for fintech gamers.

“We might want to do schooling on what we’re providing, however dramatically much less so over the previous few years as Islamic finance has develop into extra mainstream and extensively accepted in Muslim-majority nations, like Indonesia,” he stated.

[ad_2]